Metamaterial Waveguide Engineering Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Metamaterial Waveguide Engineering

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

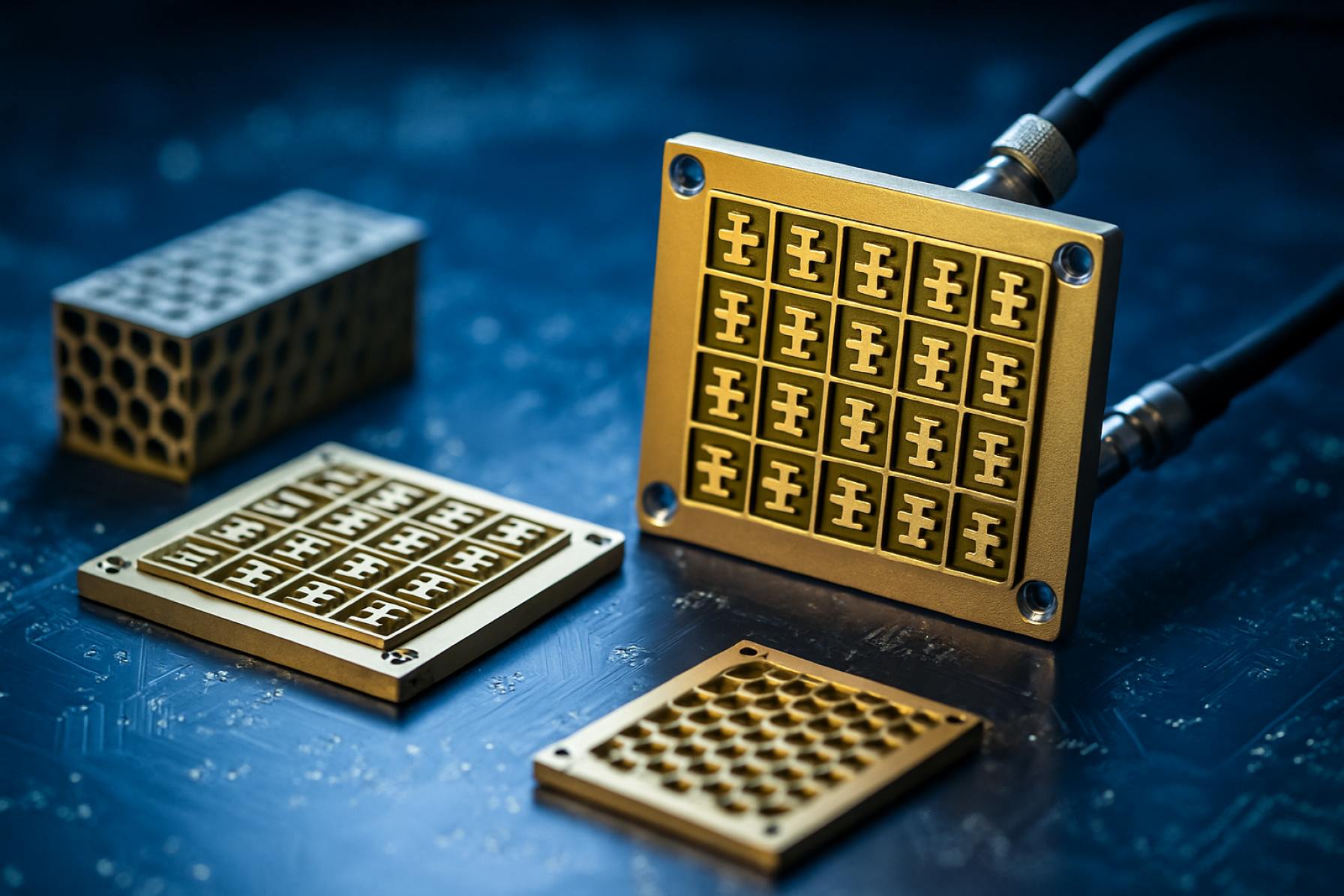

Metamaterial waveguide engineering is an advanced field within photonics and materials science, focusing on the design and fabrication of waveguides that leverage the unique electromagnetic properties of metamaterials. Metamaterials are artificially structured materials engineered to exhibit properties not found in naturally occurring substances, such as negative refractive index and tailored electromagnetic responses. These properties enable unprecedented control over light propagation, confinement, and manipulation at subwavelength scales, making metamaterial waveguides critical for next-generation optical communication, sensing, and quantum information technologies.

The global metamaterial waveguide engineering market is poised for robust growth in 2025, driven by escalating demand for high-speed data transmission, miniaturized photonic devices, and advanced sensing solutions. According to MarketsandMarkets, the broader metamaterials market is projected to reach USD 4.1 billion by 2025, with waveguide applications representing a significant and rapidly expanding segment. Key industry players, including Meta Materials Inc. and NKT Photonics, are investing heavily in R&D to develop novel waveguide architectures that exploit the tunable optical properties of metamaterials for improved performance and integration.

Technological advancements in nanofabrication and material synthesis are enabling the realization of low-loss, highly efficient metamaterial waveguides suitable for integration into photonic integrated circuits (PICs) and on-chip optical interconnects. The telecommunications sector is a primary adopter, seeking to overcome bandwidth limitations and reduce energy consumption in data centers and 5G/6G infrastructure. Additionally, the defense and aerospace industries are leveraging metamaterial waveguides for compact, lightweight, and stealthy photonic systems, as highlighted by research initiatives at DARPA and collaborations with leading academic institutions.

- Asia-Pacific is emerging as a key growth region, with significant investments in photonics and quantum technologies from countries such as China, Japan, and South Korea (IDTechEx).

- Strategic partnerships between material suppliers, device manufacturers, and research organizations are accelerating commercialization and standardization efforts.

- Challenges remain in large-scale manufacturing, cost reduction, and integration with existing semiconductor processes, but ongoing innovation is expected to address these barriers in the near term.

In summary, metamaterial waveguide engineering is at the forefront of photonic innovation in 2025, with strong market momentum, cross-sector adoption, and a dynamic ecosystem of stakeholders driving technological and commercial breakthroughs.

Key Technology Trends in Metamaterial Waveguide Engineering

Metamaterial waveguide engineering is rapidly evolving, driven by the demand for advanced photonic and electromagnetic devices across telecommunications, sensing, and quantum computing. In 2025, several key technology trends are shaping the landscape of this field, reflecting both breakthroughs in material science and the integration of novel fabrication techniques.

- Integration of 2D Materials: The incorporation of two-dimensional (2D) materials such as graphene and transition metal dichalcogenides into metamaterial waveguides is enabling unprecedented control over light-matter interactions. These materials offer tunable optical properties, high carrier mobility, and compatibility with existing semiconductor processes, facilitating the development of ultra-compact, low-loss waveguides for next-generation photonic circuits (Nature Reviews Materials).

- Topological Photonics: The application of topological concepts to metamaterial waveguides is leading to robust light propagation immune to defects and disorder. Topological insulator-based waveguides are being explored for their potential to support lossless edge states, which is critical for reliable on-chip optical interconnects and quantum information processing (Optica).

- Reconfigurable and Tunable Metamaterials: Advances in phase-change materials, microelectromechanical systems (MEMS), and liquid crystals are enabling dynamic control over waveguide properties. This reconfigurability allows for real-time tuning of waveguide dispersion, polarization, and transmission characteristics, supporting adaptive photonic systems for applications such as beam steering and programmable optical circuits (Nature Reviews Materials).

- Subwavelength Confinement and Loss Mitigation: New fabrication techniques, including nanoimprint lithography and atomic layer deposition, are pushing the limits of subwavelength light confinement while minimizing propagation losses. These advances are crucial for integrating metamaterial waveguides into dense photonic chips and for enhancing the performance of sensors and modulators (Materials Today).

- Hybrid Integration with Silicon Photonics: The convergence of metamaterial waveguides with silicon photonics platforms is accelerating commercialization. Hybrid devices leverage the scalability of silicon manufacturing with the unique functionalities of metamaterials, enabling mass-producible, high-performance photonic components for data centers, 5G/6G networks, and LiDAR systems (International Data Corporation (IDC)).

These trends underscore a shift toward multifunctional, scalable, and reconfigurable photonic systems, positioning metamaterial waveguide engineering as a cornerstone of future optical technologies.

Competitive Landscape and Leading Players

The competitive landscape of the metamaterial waveguide engineering market in 2025 is characterized by a dynamic mix of established photonics companies, deep-tech startups, and research-driven spin-offs. The sector is witnessing rapid innovation, with players focusing on the development of advanced waveguide architectures for applications in telecommunications, LiDAR, augmented reality (AR), and quantum computing.

Key industry leaders include Meta Materials Inc., which leverages proprietary nanofabrication techniques to produce tunable waveguides for next-generation optical devices. The company’s strategic partnerships with telecom and defense sectors have solidified its position as a frontrunner in commercializing metamaterial-based solutions.

Another significant player is Lumotive, which specializes in beam-steering waveguides for LiDAR and AR applications. Their use of dynamic metasurfaces enables compact, solid-state solutions that are gaining traction in automotive and consumer electronics markets. Similarly, NKT Photonics is advancing the integration of metamaterial waveguides into high-performance fiber lasers and sensing systems, targeting industrial and scientific end-users.

Startups such as Aryballe and Avatar Materials are pushing the boundaries of miniaturization and functional integration, focusing on niche applications like chemical sensing and biomedical imaging. These companies often collaborate with academic institutions to accelerate R&D and secure intellectual property.

The competitive environment is further shaped by the involvement of major technology conglomerates. Microsoft and Apple have both invested in metamaterial waveguide research for AR headsets, seeking to enhance display performance and reduce device form factors. Their entry has intensified competition and spurred a wave of M&A activity, as smaller firms with unique fabrication capabilities become attractive acquisition targets.

- Strategic alliances and joint ventures are common, with companies pooling resources to overcome manufacturing challenges and accelerate commercialization.

- Patent portfolios and proprietary fabrication methods are key differentiators, with leading players investing heavily in IP protection.

- Geographically, North America and Europe dominate the market, but significant R&D investments are emerging from Asia-Pacific, particularly in China and South Korea.

Overall, the 2025 metamaterial waveguide engineering market is marked by rapid technological evolution, intense competition, and a growing emphasis on scalable manufacturing and end-user customization.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global metamaterial waveguide engineering market is poised for robust growth between 2025 and 2030, driven by accelerating demand for advanced photonic and electromagnetic solutions across telecommunications, defense, and consumer electronics. According to projections from MarketsandMarkets, the broader metamaterials market is expected to achieve a compound annual growth rate (CAGR) exceeding 20% during this period, with waveguide engineering representing a significant and rapidly expanding subsegment.

Revenue forecasts for metamaterial waveguide engineering specifically indicate a surge from an estimated $350 million in 2025 to over $900 million by 2030, reflecting a CAGR of approximately 21.5%. This growth is underpinned by increasing integration of metamaterial-based waveguides in 5G/6G infrastructure, LiDAR systems, and next-generation optical interconnects. The telecommunications sector is anticipated to account for the largest share of revenue, as operators invest in high-capacity, low-loss waveguide solutions to support escalating data traffic and network densification initiatives (IDTechEx).

Volume analysis reveals a parallel trend, with unit shipments of metamaterial waveguide components projected to grow at a CAGR of 23% from 2025 to 2030. This expansion is fueled by both established players and emerging startups scaling up production to meet demand from OEMs in the photonics and wireless communication industries. Notably, Asia-Pacific is expected to lead in volume growth, driven by aggressive infrastructure rollouts in China, South Korea, and Japan, while North America and Europe maintain strong adoption rates in defense and aerospace applications (Grand View Research).

- Key Growth Drivers: Proliferation of high-frequency communication networks, miniaturization of photonic devices, and advancements in fabrication techniques.

- Challenges: High production costs, scalability issues, and the need for standardization in design and testing protocols.

- Opportunities: Integration with quantum computing, medical imaging, and automotive radar systems.

In summary, the metamaterial waveguide engineering market is set for dynamic expansion through 2030, with strong revenue and volume growth underpinned by technological innovation and cross-sector adoption.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional market analysis for metamaterial waveguide engineering in 2025 reveals distinct growth trajectories and adoption patterns across North America, Europe, Asia-Pacific, and the Rest of the World. Each region’s market dynamics are shaped by factors such as R&D investment, industrial applications, regulatory frameworks, and the presence of key players.

- North America: North America, led by the United States, remains at the forefront of metamaterial waveguide engineering. The region benefits from robust funding for advanced photonics and telecommunications research, with significant contributions from institutions like National Science Foundation and defense agencies. The presence of leading companies and startups, such as Meta Materials Inc., accelerates commercialization, particularly in 5G/6G infrastructure, aerospace, and defense. The U.S. market is projected to maintain a CAGR above 20% through 2025, driven by demand for high-performance, miniaturized optical components and government-backed innovation initiatives.

- Europe: Europe’s metamaterial waveguide market is characterized by strong academic-industry collaboration and a focus on sustainable, energy-efficient photonic devices. The European Union’s Horizon Europe program and national funding from countries like Germany and the UK support R&D in next-generation communication and sensing technologies. Companies such as Photonics21 and Oxford Instruments are active in developing waveguide-based solutions for medical imaging, automotive LiDAR, and quantum computing. The region is expected to see steady growth, with a CAGR of 17-19% in 2025, as regulatory support and public-private partnerships drive innovation.

- Asia-Pacific: Asia-Pacific is emerging as a high-growth market, propelled by rapid industrialization, expanding telecommunications infrastructure, and government initiatives in countries like China, Japan, and South Korea. Major investments in 5G/6G, IoT, and advanced manufacturing are fostering demand for metamaterial waveguides. Companies such as NTT Communications and Huawei Technologies are investing in R&D and commercialization. The region is forecasted to achieve the highest CAGR globally, potentially exceeding 25% in 2025, as local supply chains mature and export opportunities expand.

- Rest of World: The Rest of the World, including Latin America, the Middle East, and Africa, is at an earlier stage of adoption. Growth is primarily driven by pilot projects in telecommunications and defense, with increasing interest from academic institutions and government agencies. While the market size remains smaller compared to other regions, targeted investments and technology transfer initiatives are expected to gradually boost adoption rates through 2025.

Overall, the global landscape for metamaterial waveguide engineering in 2025 is marked by regional strengths: North America’s innovation leadership, Europe’s collaborative ecosystem, Asia-Pacific’s rapid industrial uptake, and emerging opportunities in the Rest of the World. These dynamics are expected to shape both the pace and direction of market expansion in the coming years.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for metamaterial waveguide engineering in 2025 is marked by rapid innovation, expanding applications, and intensifying investment activity. As the demand for high-performance photonic and electromagnetic devices accelerates, metamaterial-based waveguides are poised to play a pivotal role in next-generation communication, sensing, and computing technologies.

Emerging applications are particularly prominent in the fields of 6G wireless communications, quantum information processing, and advanced medical imaging. In telecommunications, metamaterial waveguides enable ultra-compact, low-loss, and highly tunable signal routing, which is essential for the anticipated data rates and latency requirements of 6G networks. Companies such as Nokia and Ericsson are actively exploring metamaterial-enabled components to enhance network infrastructure and spectrum efficiency.

In quantum computing and information, the precise control over light-matter interactions afforded by metamaterial waveguides is facilitating the development of robust quantum interconnects and on-chip photonic circuits. Research initiatives at institutions like MIT and University of Oxford are driving breakthroughs in this area, with the potential to accelerate commercialization by 2025.

Medical imaging and biosensing represent another investment hotspot. Metamaterial waveguides are being integrated into compact, high-resolution imaging systems and lab-on-chip diagnostic devices, offering improved sensitivity and miniaturization. Startups and established players, including Siemens Healthineers and GE HealthCare, are investing in R&D to leverage these advantages for next-generation healthcare solutions.

From an investment perspective, venture capital and corporate funding are increasingly targeting metamaterial waveguide startups and scale-ups. According to IDTechEx, the global metamaterials market is projected to surpass $5.5 billion by 2025, with waveguide technologies accounting for a significant share of new investments. Strategic partnerships between material innovators and device manufacturers are also accelerating technology transfer and commercialization.

In summary, 2025 is expected to witness a surge in both the breadth of applications and the depth of investment in metamaterial waveguide engineering. The convergence of telecommunications, quantum technologies, and biomedical innovation positions this sector as a critical enabler of future high-impact technologies.

Challenges, Risks, and Strategic Opportunities

Metamaterial waveguide engineering, while promising transformative advances in photonics, telecommunications, and sensing, faces a complex landscape of challenges and risks in 2025. The primary technical challenge remains the scalable fabrication of metamaterials with precise nanoscale features. Achieving uniformity and reproducibility at commercial volumes is difficult, as even minor deviations in structure can significantly alter electromagnetic properties. This is particularly acute for waveguides, where losses due to scattering and absorption can undermine performance gains. According to IDTechEx, manufacturing yield and cost control are persistent bottlenecks, especially for applications requiring large-area or flexible substrates.

Material compatibility and integration with existing photonic platforms also pose risks. Many metamaterial designs rely on exotic or non-standard materials, which may not be compatible with established silicon photonics or CMOS processes. This complicates integration and increases the risk of supply chain disruptions, as highlighted by MarketsandMarkets. Furthermore, the long-term reliability and environmental stability of metamaterial waveguides—especially under high-power or harsh operating conditions—remain underexplored, raising concerns for mission-critical applications in aerospace and defense.

From a regulatory and intellectual property perspective, the field is highly competitive and fragmented. Patent thickets and overlapping claims can slow innovation and increase litigation risks, as noted by Lux Research. Additionally, the lack of standardized testing and performance benchmarks complicates customer adoption and market validation.

Despite these challenges, strategic opportunities abound. The growing demand for miniaturized, high-performance optical components in 5G/6G communications, LiDAR, and quantum computing is driving investment in metamaterial waveguide R&D. Partnerships between metamaterial startups and established photonics manufacturers are accelerating technology transfer and de-risking scale-up, as seen in recent collaborations tracked by OODA Loop. Furthermore, advances in machine learning-driven design and additive manufacturing are opening new pathways for rapid prototyping and optimization of complex waveguide geometries.

In summary, while metamaterial waveguide engineering in 2025 faces significant technical, integration, and market risks, the sector is positioned for growth through strategic alliances, process innovation, and the expanding need for next-generation photonic devices.

Sources & References

- MarketsandMarkets

- Meta Materials Inc.

- NKT Photonics

- DARPA

- IDTechEx

- Nature Reviews Materials

- International Data Corporation (IDC)

- Lumotive

- Aryballe

- Microsoft

- Apple

- Grand View Research

- National Science Foundation

- Photonics21

- Oxford Instruments

- Huawei Technologies

- Nokia

- MIT

- University of Oxford

- Siemens Healthineers

- GE HealthCare

- Lux Research